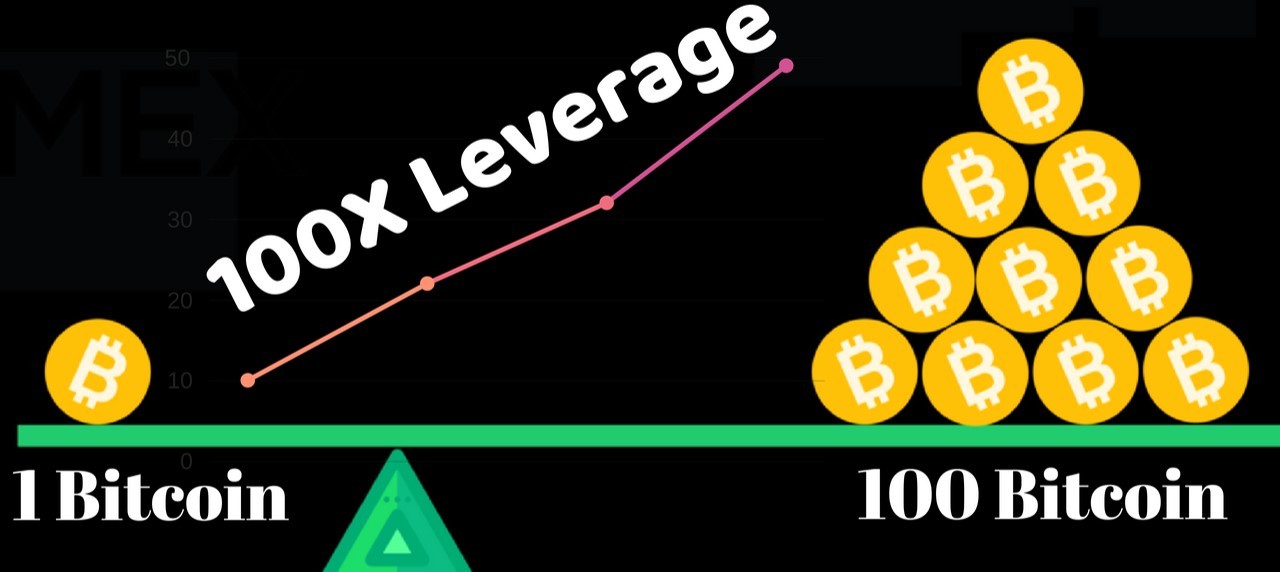

The Fact That You Can Go 100x Leverage on Bitcoin Is Pretty Wild

Fact That You Can Go 100x Leverage on Bitcoin Is Pretty Wild because it allows you to amplify your profits and losses by 100 times.

Bitcoin is a volatile asset. Its price can swing wildly in either direction on any given day. This volatility makes Bitcoin a risky investment, but it also makes it a potentially lucrative one.

One way to amplify your potential profits from Bitcoin is to use leverage. Leverage allows you to borrow money from a broker to trade with more money than you actually have. This can be a very effective way to increase your profits, but it can also be very risky.

For example, if you have $1,000 and you use 100x leverage, you will be able to trade with $100,000. If Bitcoin goes up by 1%, you will make a profit of $1,000. However, if Bitcoin goes down by 1%, you will lose your entire investment.

Leverage can be a very dangerous tool, especially for inexperienced traders. It is important to understand the risks involved before using leverage.

Why is 100x leverage on Bitcoin so wild?

100x leverage on Bitcoin is wild because it allows you to amplify your profits and losses by 100 times. This means that a small movement in the price of Bitcoin can have a huge impact on your account balance.

For example, if you have $1,000 in your account and you use 100x leverage, a 1% move in the price of Bitcoin will result in a $100 profit or loss. This means that you could make or lose 10% of your account balance in a single day.

The risks of using leverage on Bitcoin

Leverage can be a very risky tool, especially for inexperienced traders. Here are some of the risks involved:

- You can lose more money than you invest. If Bitcoin goes down in price, you can lose your entire investment and more. This is because you are borrowing money from your broker to trade with.

- You can be liquidated. If your account balance falls below a certain threshold, your broker will liquidate your positions. This means that they will sell your Bitcoin in order to recoup their losses.

- You can be margin called. If your account balance falls below a certain threshold, your broker will issue you a margin call. This means that you need to deposit more money into your account in order to maintain your positions. If you do not deposit more money, your broker will liquidate your positions.

Tips for using leverage safely

If you are considering using leverage on Bitcoin, here are some tips to help you stay safe:

- Start with a small amount of money. It is important to start with a small amount of money when you are first starting out. This will help you to learn how to use leverage without risking too much money.

- Use stop-loss orders. Stop-loss orders are orders that automatically sell your Bitcoin when it reaches a certain price. This can help you to limit your losses if the price of Bitcoin goes down.

- Don't overextend yourself. It is important to not overextend yourself when using leverage. Don't trade with more money than you can afford to lose.

100x leverage on Bitcoin is a very powerful tool, but it is also a very dangerous one. It is important to understand the risks involved before using leverage. If you are new to trading, it is best to start with a small amount of money and use stop-loss orders to limit your losses.

What's Your Reaction?